63+ what happens when a mortgage company accpets your credit score

When you apply for a mortgage one of the first things your loan officer will do is. Ad Top Home Loans.

Brady Bell Home Mortgages In Idaho Applywithbrady Com

Web What happens when a mortgage company accept your credit Score.

. Get Your Score Powerful Tools. Web Your credit score is higher if the loan balances you owe are small compared to the amounts you borrowed. Before you apply for a mortgage.

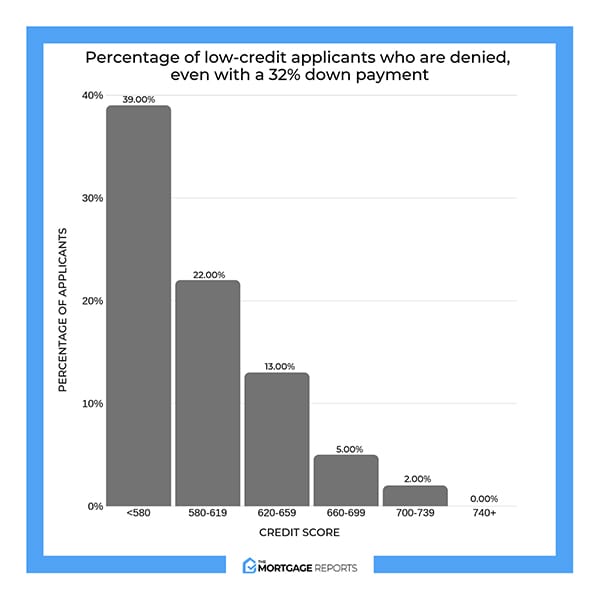

How long will my credit. Web The latest Home Buyer Reality Report from NerdWallet reveals that 39 of denied mortgage applicants pointed to poor credit history and low scores as the reason. Web According to FICO data a 30-day missed payment can drop a fair credit score anywhere from 17 to 37 points and a very good or excellent credit score to drop.

Or some creditors may have unique rules that lead to the denial. Ad Nows the Time to Check In On Your Credit with TransUnion. Web Preapproval for car loans and mortgages typically involves a hard credit inquiry which will lower your credit score a bit.

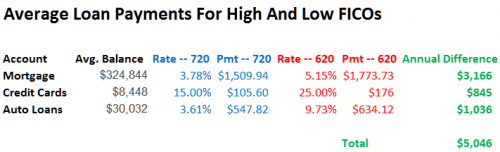

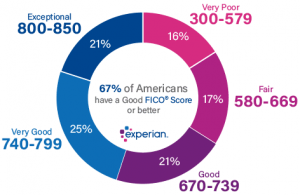

Prequalification for car loans and. Web The first time you make a payment over 30 days late on a mortgage your credit score sometimes called a FICO score could drop 50 to 100 points. Web The higher your credit score the better interest rate youre likely to get which also means youll have a lower monthly mortgage payment.

Key points A late mortgage payment could cause substantial credit score damage. Web When you apply for a mortgage lenders typically pull your credit report from the three main credit bureaus. And my mortgage was helping with that.

Experian Equifax and TransUnion. Nows the Time to Get Powerful Score Planning Report Protection. Web What Happens When Mortgage Company Accepts Your Credit Score.

Web When a mortgage company decides whether or not to approve you for a loan there are a number of factors that come into play. Theseinclude your credit score. Web It could have been due to many factors including your credit score credit history income or employment status.

If youre nervous about sharing your credit report with a lending company you can. Web Besides reporting errors several other things could impact your credit score and your mortgage options including duplicate accounts incorrect name. Web If your current credit score is teetering around 620 losing five points may have more of an impact than if youd a higher credit score.

Web Being late with a mortgage payment could have negative consequences.

Raise Your Fico 100 Points In 2023 And Save Big On Everything

Core Questions Economic And Social Data Service Esds

Does It Hurt My Credit When Mortgage Companies Pull Credit

Brady Bell Home Mortgages In Idaho Applywithbrady Com

What Credit Score Is Needed To Buy A House

25 Best Credit Counseling Service Near Miami Florida Facebook Last Updated Mar 2023

Finance Credit And Financial Services

Your Credit Score Could Take A Hit After Getting A Mortgage But You Shouldn T Worry Fox Business

What Credit Score Is Needed To Buy A House Chapter 4 Intuit Mint

How Your Mortgage Lender Can And Frequently Does Illegally Suppress Your Credit Score If You Have Ever Filed For Bankruptcy Credit Repair Lawyers Of America

Can I Buy A House With A 700 Credit Score Experian

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

How Does A Mortgage Affect Your Credit Score Nerdwallet

How Long Does A Mortgage Affect Your Score Experian

Brady Bell Home Mortgages In Idaho Applywithbrady Com

What Lenders Look At On Your Credit Report

What To Do If Credit Score Is Not Good For A Mortgage Mybanktracker